Visual Capitalist |

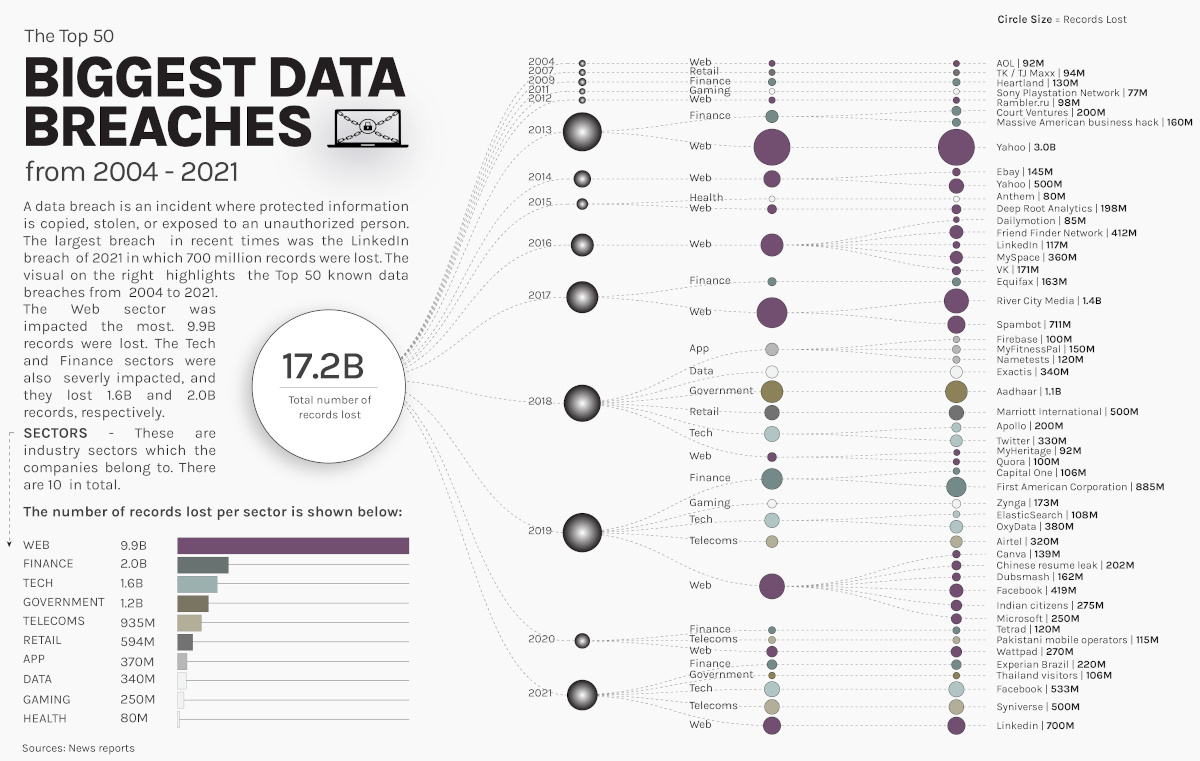

- Visualizing The 50 Biggest Data Breaches From 2004–2021

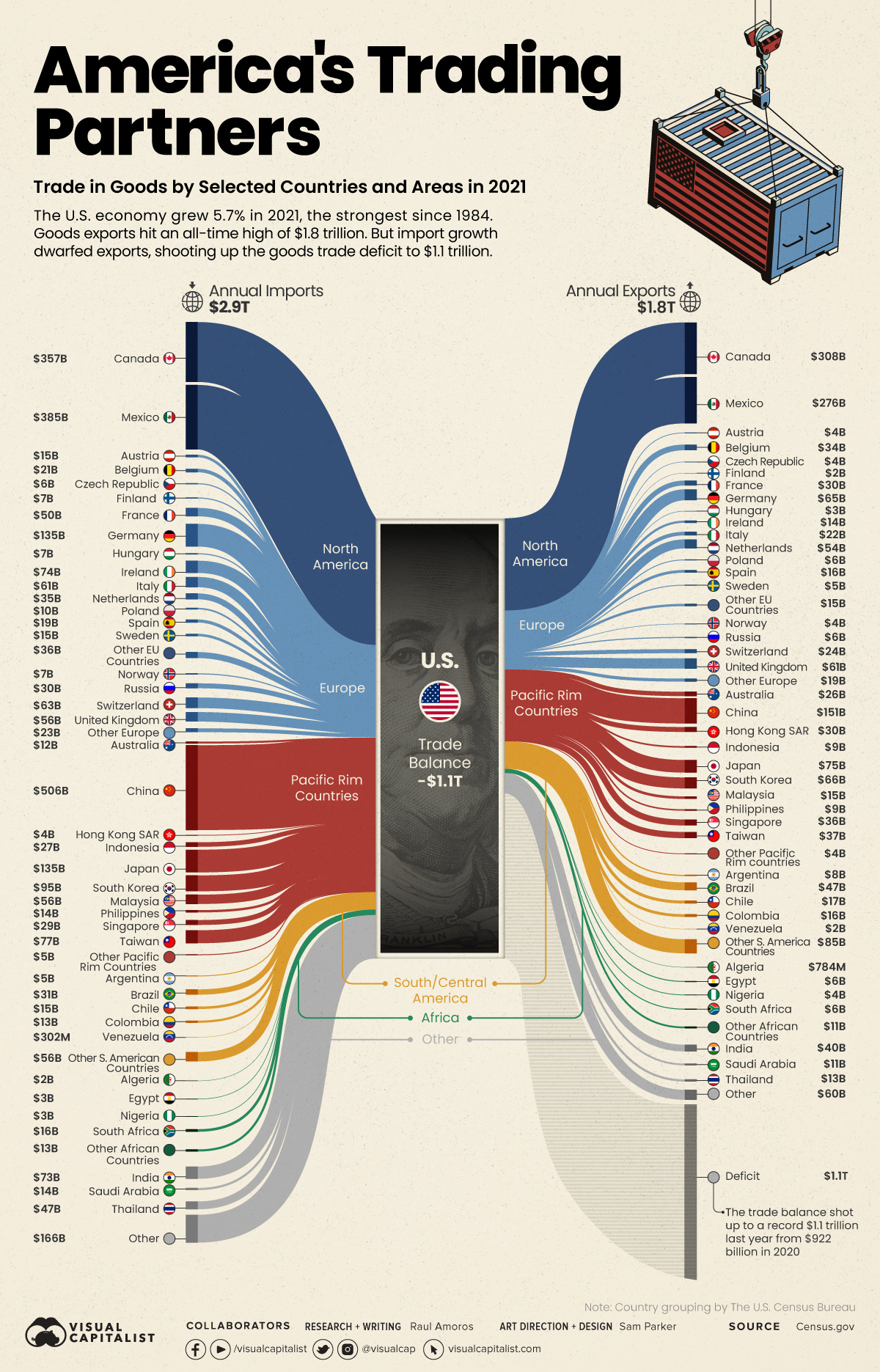

- Ranked: Visualizing the Largest Trading Partners of the U.S.

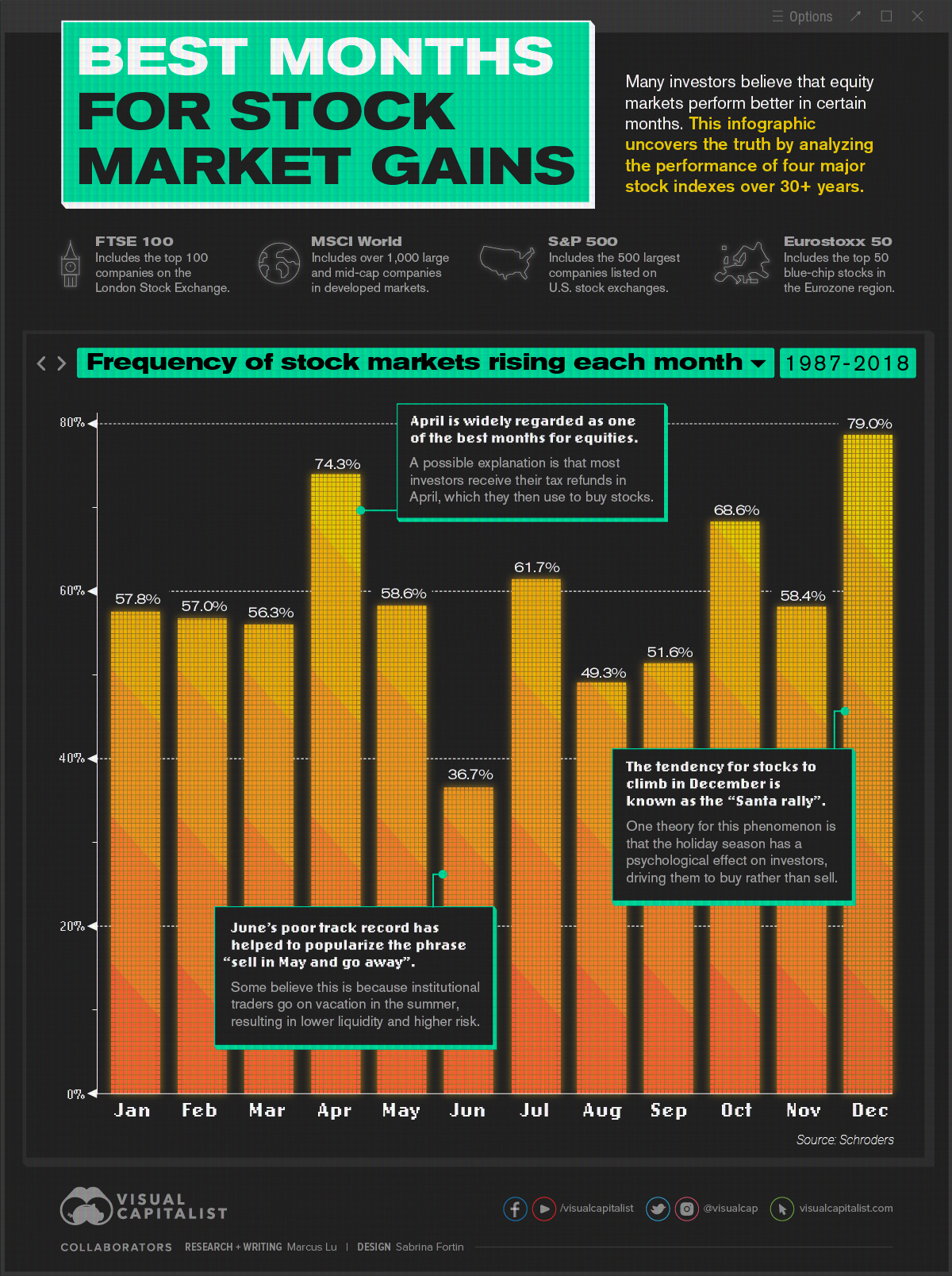

- The Best Months for Stock Market Gains

- What’s New on VC+ in June?

| Visualizing The 50 Biggest Data Breaches From 2004–2021 Posted: 01 Jun 2022 12:23 AM PDT View high-resolution version of infographic Visualizing The 50 Biggest Data Breaches From 2004–2021As our world has become increasingly reliant on technology and data stored online, data breaches have become an omnipresent threat to users, businesses, and government agencies. In 2021, a new record was set with more than 5.9 billion user records stolen. This graphic by Chimdi Nwosu visualizes the 50 largest data breaches since 2004, along with the sectors most impacted. Data was aggregated from company statements and news reports. Understanding the Basics of Data BreachesA data breach is an incident in which sensitive or confidential information is copied, transmitted or stolen by an unauthorized entity. This can occur as a result of malware attacks, payment card fraud, insider leaks, or unintended disclosure. The targeted data is often customer PII (personally identifiable information), employee PII, intellectual property, corporate data or government agency data. Date breaches can be perpetrated by lone hackers, organized cybercrime groups, or even national governments. Stolen information can then be used in other criminal enterprises such as identity theft, credit card fraud, or held for ransom payment. Notable Data Breaches Since 2004The largest data breach recorded occurred in 2013 when all three billion Yahoo accounts had their information compromised. In that cyberattack, the hackers were able to gather the personal information and passwords of users. While the full extent of the Yahoo data breach is still not fully realized, subsequent cybercrimes across the globe have been linked to the stolen information. Here are the 50 largest data breaches by amount of user records stolen from 2004–2021.

The massive Yahoo hack accounted for roughly 30% of the 9.9 billion user records stolen from the Web sector—by far the most impacted sector. The next most-impacted sectors were Tech and Finance, with 2 billion and 1.6 billion records stolen, respectively. Although these three sectors had the highest totals of user data lost, that doesn’t necessarily imply they have weaker security measures. Instead, it can probably be attributed to the sheer number of user records they compile. Not all infamous data breaches are of a large scale. A smaller data breach in 2014 made headlines when Apple's iCloud was hacked and the personal pictures of roughly 200 celebrities were disseminated across the internet. Although this highly targeted hack only affected a few hundred people, it highlighted how invasive and damaging data breaches can be to users. The Cost of Data Breaches to BusinessesEvery year data breaches cost businesses billions of dollars to prevent and contain, while also eroding consumer trust and potentially having an adverse effect on customer retention. A 2021 IBM security report estimated that the average cost per data breach for companies in 2020 was $4.2 million, which represents a 10% increase from 2019. That increase is mainly attributed to the added security risk associated with having more people working remotely due to the COVID-19 pandemic. Measures to Improve Data SecurityCompletely preventing data breaches is essentially impossible, as cybercrime enterprises are often persistent, dynamic, and sophisticated. Nevertheless, businesses can seek out innovative methods to prevent exposure of data and mitigate potential damages. For example, after the iCloud attack in 2014, Apple began avidly encouraging users to adopt two-factor authentication in an effort to strengthen data security. Regardless of the measures businesses take, the unfortunate reality is that data breaches are a cost of doing business in the modern world and will continue to be a concern to both companies and users. The post Visualizing The 50 Biggest Data Breaches From 2004–2021 appeared first on Visual Capitalist. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ranked: Visualizing the Largest Trading Partners of the U.S. Posted: 31 May 2022 10:06 AM PDT

Ranked: The Largest Trading Partners of the U.S.The U.S. economy grew 5.7% in 2021, the fastest pace since 1984, bouncing back from the economic downturn created by the pandemic. But as supply chain issues reared their head and international restrictions came in and out of play, how did the country’s trade situation shape up? America's trade deficit of goods shot up to a whopping record $1.1 trillion in 2021 from $922 billion in 2020, leading to its largest ever deficit. Imports dwarfed exports, reaching new highs of $2.9 trillion in 2021, while U.S. exports to other countries added up to $1.8 trillion. Using the latest data on international trade from the U.S. Census Bureau, we've visualized the flow of America's annual imports and exports for selected countries. The difference between the two measures is the country’s trade deficit for goods. Who Does the U.S. Trade Most With?In 2021, U.S trade of goods amounted to nearly $4.6 trillion and Canada, Mexico, and China were America’s largest trading partners. Those three countries alone combined for a total trade of $1.9 trillion, equal to about 41% of all trade of goods. Let's take a look at the 10 countries that trade the most with the United States:

From a geographic perspective, the two largest trading partners are based in North America (Canada and Mexico). Meanwhile, six of the top 10 are based in Asia. Which Countries Does the U.S. Have the Largest Trade Deficit With?The largest trade deficit is undoubtedly with China, which accounts for more than 32% of the U.S. trade deficit in goods. The $355 billion deficit with China comes from importing $506 billion in goods such as machinery, furniture, and bedding. Interestingly, many of those imports are made by American companies who outsource their production to China. These outsourcing activities are counted as imports even though they create profit for these U.S. companies. Below we order U.S. trade partners by trade deficit of goods:

The second largest U.S. trade deficit is with Mexico with $108 billion. The main imports from Mexico are cars, trucks, and auto parts. On the other side, the main exports are auto parts and petroleum products. How Does a Trade Deficit Affect the U.S. Economy?The U.S. has been running trade deficits since the late 1970s, so these latest numbers are a continuation of a long-term trend. Are these trade deficits a bad thing? The simple, unsatisfying answer is, it depends. When any country spends more money on imports than it makes on exports, it must somehow make up the shortfall. Typically, this means takes the form of borrowing from foreign lenders or allowing foreign investment in domestic assets. In the U.S., the trade imbalance with China is a sore point, as millions of jobs in manufacturing have been lost due to offshoring in recent decades. That said, running a trade surplus is no guarantee of strong economic performance. Germany is a prime example of a country with a massive trade surplus, but achieving only modest economic growth in recent years. The post Ranked: Visualizing the Largest Trading Partners of the U.S. appeared first on Visual Capitalist. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Best Months for Stock Market Gains Posted: 30 May 2022 11:42 AM PDT

The Best Months for Stock Market GainsMany investors believe that equity markets perform better during certain times of the year. Is there any truth to these claims, or is it superstitious nonsense? This infographic uses data gathered by Schroders, a British asset management firm, to investigate. What the Data SaysThis analysis is based on 31 years of performance across four major stock indexes:

The percentages in the following table represent the historical frequency of these indexes rising in a given month, between the years 1987 and 2018. Months are ordered from best to worst, in descending order.

There are some outliers in this dataset that we'll focus on below. The Strong MonthsIn terms of frequency of growth, December has historically been the best month to own stocks. This lines up with a phenomenon known as the "Santa Claus Rally", which suggests that equity markets rally over Christmas. One theory is that the holiday season has a psychological effect on investors, driving them to buy rather than sell. We can also hypothesize that many institutional investors are on vacation during this time. This could give bullish retail investors more sway over the direction of the market. The second best month was April, which is commonly regarded as a strong month for the stock market. One theory is that many investors receive their tax refunds in April, which they then use to buy stocks. The resulting influx of cash pushes prices higher. Speaking of higher prices, we can also look at this trend from the perspective of returns. Focusing on the S&P 500, and looking back to 1928, April has generated an average return of 0.88%. This is well above the all-month average of 0.47%. The Weak MonthsThe three worst months to own stocks, according to this analysis, are June, August, and September. Is it a coincidence that they're all in the summer? One theory for the season's relative weakness is that institutional traders are on vacation, similar to December. Without the holiday cheer, however, the market is less frothy and the reduced liquidity leads to increased risk. Whether you believe this or not, the data does show a convincing pattern. It's for this reason that the phrase "sell in May and go away" has become popularized. Key TakeawaysInvestors should remember that this data is based on historical results, and should not be used to make forward-looking decisions in the stock market. Anomalies like the COVID-19 pandemic in 2020 can have a profound impact on the world, and the market as a whole. Stock market performance during these times may deviate greatly from their historical averages seen above. Regardless, this analysis can still be useful to investors who are trying to understand market movements. For example, if stocks rise in December without any clear catalyst, it could be the famed Santa Claus Rally at work. The post The Best Months for Stock Market Gains appeared first on Visual Capitalist. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 May 2022 10:39 PM PDT If you're a regular visitor to Visual Capitalist, you know that we're your home base for data-driven, visual storytelling that helps explain a complex world. But did you know there's a way to get even more out of Visual Capitalist, all while helping support the work we do? More Visuals. More Insight. More Understanding.

VC+ is our premium subscription that gives you exclusive access to extra visual content and insightful special features. It also gets you access to The Trendline, our twice a week members-only newsletter that features the very best visualizations and data releases. So, what is getting sent to members in the coming weeks for VC+ in June? “Markets this Month: June Edition”SPECIAL DISPATCH: Everything You Need to Know for this Upcoming Month in the Markets. June's edition will include:

Coming Wednesday, June 1st, 2022 (Get VC+ to access) “Ask Us Anything with the Elements Team”SPECIAL DISPATCH: The Elements Team Answers Questions Submitted by VC+ Subscribers

Have surging commodity and energy prices left you looking for answers? We've rounded up the VC Elements team to help make sense of the physical materials behind these trends. VC+ subscribers will be able to submit questions ahead of time, with the team providing answers and insights on energy, metals, and more. Coming Tuesday, June 21st, 2022 (Get VC+ to access) The TrendlinePREMIUM NEWSLETTER: Our Bi-Weekly Newsletter for VC+ Members The Sunday Edition The Midweek Edition The Best Visualizations Each Week The Best Data and Reports Each Week >> View free sample >> View free sample The Trendline is our premium newsletter sent to VC+ members twice a week. On Sundays, we highlight the best visualizations on business, investing, and global trends that our editors have uncovered. On Thursdays in the Midweek Edition, we send you a round-up of the most interesting reports we find along with key charts and commentary. The Trends Shaping the World—in Your InboxGet access to these upcoming features by becoming a VC+ member. And for a limited time, get 25% off, which makes your VC+ membership the same price as a coffee each month: PS – We look forward to sending you even more great visuals and data! The post What’s New on VC+ in June? appeared first on Visual Capitalist. |

| You are subscribed to email updates from Visual Capitalist. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Canada

Canada Mexico

Mexico China

China Japan

Japan Germany

Germany South Korea

South Korea United Kingdom

United Kingdom Taiwan

Taiwan India

India Vietnam

Vietnam Ireland

Ireland Malaysia

Malaysia Italy

Italy

No comments:

Post a Comment