SaaStr |

- The Top 10 Important Finance Mistakes First Time Founders Make

- Why Founder-Led Sales Breaks Earlier Than You Think

- Top Post & Vids of the Week: CRO Box, CMO Calendly, COO Asana, CCO Figma, and More!

- Dear SaaStr: Do VCs Prefer Startups With No Competiton, Or Those Disrupting Competitive Spaces?

- Want To Steal a Customer from the Competition? You Gotta Do The Work

- Dear SaaStr: Should I Move Our Fiscal Year From Dec 31 to Jan 31? Will It Help The Team?

- 7 Changes You Can Make >Today< To Grow Faster

| The Top 10 Important Finance Mistakes First Time Founders Make Posted: 24 Jan 2022 06:20 AM PST This SaaStr Classic post didn’t much of an update, but we added a few things to it. Take a read if you are still running finance yourself, or just have an part-time outsourced resource. — Jason, ed. In the old days, we didn’t have to worry about finance too much. Companies grew more slowly, there was nothing for a CFO to really do for years, and you could sort of outsource everything and just keep an eye on the bank statement. Things have changed a lot. SaaS accounting and finance has gotten pretty complicated, and the impacts of getting it wrong have gone up substantially. I’ll give you a couple of examples. Last year, I met with the founder of a start-up I really, really liked. The plan and numbers he had, both for last year and the coming year, were impressive and aggressive. But it was on the margin — the ACVs were low, and the CAC was high. And then — he sent me his financials. They didn’t make any sense. I simply couldn’t get them to even remotely tie to his presentation deck. Was it misunderstanding bookings vs. ARR vs. GAAP revenue, was that the issue? I couldn’t even figure that out. Anyhow, the gap, the delta was so large … I just had to pass. It was too big a flag for a company at the edge of where I like to invest. I’ve also seen upside surprises, which sound good, but sometimes aren’t. I’ve worked with numerous start-ups that used outsourced accounting services with zero SaaS experience, and these firms didn’t even recognize automatic upsells, additional seats, etc. that weren’t captured in existing, crappy tracking systems. The delta was often huge — as much as 30-40%. In the early days, I guess it doesn’t matter. Cash is king. But in SaaS, once you even get to about $2m ARR — it’s time to get your finances in order. You may blow a financing round, get your cash runway wrong, or at least, freak your investors out if you don’t. With that, I asked my first controller at my first start-up, Anita Kutlesa, who has since gone on to be CFO at several SaaS and software companies, from Pipedrive to Coverity and more, to share her suggestions and learnings: …

|

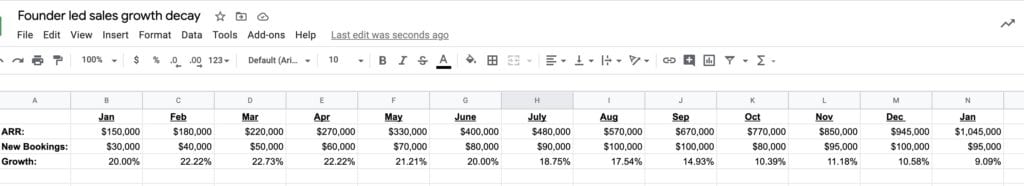

| Why Founder-Led Sales Breaks Earlier Than You Think Posted: 23 Jan 2022 06:54 AM PST

Over the years at SaaStr we’ve talked a lot about hiring a great VP of Sales, when it works, when it doesn’t, and how it moves the needle. Put simply, a great VP of Sales will come in and if nothing else, take whatever leads you have … and get more out of them. Close more of them. And close them for more money, on average. The combination of the two alone can dramatically increase your new bookings, even with the exact same number of leads. More on that here. What we haven’t discussed as much is the simple math on the flip side … what happens if things are going OK, so you decide to hold off. To stick with founder-led sales longer than most folks do, i.e. past $1.5m-$2m ARR or so. Sometimes this can work, especially in a heavily freemium model, and especially when you sell to very small businesses or individual developers or small teams. Sometimes, enough leads keep are coming in that even if in theory a traditional VP of Sales could close more, it doesn’t matter for now. You are growing fast enough. The distraction of building a real sales team isn’t worth it yet. Stripe didn’t begin to add a traditional sales team until 2018, and they did just fine. Although Twilio started a lot earlier … If you don’t think you need a real VP of Sales even after $1m-$2m ARR, then I’d at least suggest an admittedly obvious test. Are your new bookings still growing? And are they growing fast enough? This is the trap I find a lot of CEOs with early product-market fit fall into. On their own, or with, say, 1-3 sales reps or even happiness officers, they figure out how to close $20k a month, then $40k, then $100k a month in new bookings. That’s great. But then, it sort of slows down. That $100k in bookings, say, drops the next month to $80k, then rebounds to $120k, then back to $90k. The MRR/ARR keeps growing, because you are still adding bookings and customers. But the % growth rate begins to decay as the absolute bookings growth slows way down. Here’s an over-simplistic version of that math, but you can see it here: You can see in this example, that the % growth looks strong through the summer … even as new bookings start to flatten. Even by the end of the year, growth seems OK at 10% a month. But really, decay has set in long before that. The founder-led sales process stopped making progress in bookings growth months ago. I see this again and again. Founders push through flattening bookings for 6+ months … time they could have used to be recruiting a VP of Sales. And you should start looking early, because it takes time. It can take 6-12 months to close a great VP of Sales, because many of them already have a well-paying job that it will take time for them to leave. More on that here. So my simple advice in a simple post is just this: if you want to wait past $2m ARR to start looking for a VP of Sales, maybe that’s OK if the numbers are strong. But at least be hyper-alert to any slowdown in new bookings. Because when it comes, you’ll wish you’d hired someone who could have turned the exact same leads you now have into 50%+ more revenue. At least, begin the interviewing process the month you realize new bookings growth isn’t accelerating anymore without a VP of Sales. (note: an updated SaaStr Classic post) The post Why Founder-Led Sales Breaks Earlier Than You Think appeared first on SaaStr. |

| Top Post & Vids of the Week: CRO Box, CMO Calendly, COO Asana, CCO Figma, and More! Posted: 23 Jan 2022 06:20 AM PST Top Blog Posts This Week:

Top Videos This Week: Reaccelerating Growth at Scale with Box CRO Mark Wayland and SaaStr CEO and Founder, Jason Lemkin What’s Changed in Product-led Growth with Calendly CMO Patrick Moran How to Scale Outbound Sales with Anna Baird (CRO, Outreach), Amy Appleyard (SVP Global Sales, Malwarebytes), Michelle Benfer (VP, Head of North America Sales, HubSpot), Tony Benvenuto (SVP of Sales West, Seismic) Full-Funnel Product-Led Growth with Jenn Steele, VPM at Reprise, and Grace Tyson, VPS at Reprise Grow Your Customer Base 10x Through the Power of Self-Serve & Direct Sales w/ Asana COO Anne Raimondi & Figma CCO Amanda Kleha The post Top Post & Vids of the Week: CRO Box, CMO Calendly, COO Asana, CCO Figma, and More! appeared first on SaaStr. |

| Dear SaaStr: Do VCs Prefer Startups With No Competiton, Or Those Disrupting Competitive Spaces? Posted: 23 Jan 2022 06:07 AM PST

I think most VCs do both. We did an analysis of SaaS startups that had IPO'd and about 70% were new versions of something new, and 30% were truly new categories: So VCs like to do both. The reality is, entering an existing market especially in B2B is often faster and easier, despite the competition. But creating a new market is sometimes where the really huge outcomes come. I think the bigger change in venture in the past few years, with the rise of 1,000+ unicorns and multiple unicorns in categories, is that VCs are less worried about competition. It used to be that you couldn't make much money as a VC investing in the ultimate #2 or #3 in a space. Now, they might turn out to be worth billions. More on that here: This has fueled a lot more large funding rounds in spaces that are or can be large, often with 10+ startups raising tens of millions and more. That's a lot more common than it used to be. Startups that had plenty of competition:

The list goes on The post Dear SaaStr: Do VCs Prefer Startups With No Competiton, Or Those Disrupting Competitive Spaces? appeared first on SaaStr. |

| Want To Steal a Customer from the Competition? You Gotta Do The Work Posted: 23 Jan 2022 05:37 AM PST

You can steal a customer from a competitor. But unless they are so fed up that they'd inbound to switch — you have to go further. And most vendors are too lazy to go far enough to get folks to switch to them. I see so many reps trying to steal a customer that focus on:

None of this matters, most of the time, in SaaS. Not really. Because the switching costs are so, so high to rip one app out and replace it with another. To find the time to deploy a new app. To train the team. To figure out the corner cases that won't work as well. To learn slightly different, new ways to do the same thing. So a discount isn't remotely enough. The switching costs will far exceed the costs for the software itself, in many cases. What sales reps should be selling if they want to steal a customer from the competition is:

Imagine you heard that … Then, when there's a real bump with an existing vendor … you just might switch. But so few companies and sales orgs go this far. So very few. It's more work, no doubt, than just closing a warm inbound lead. As you get bigger, you may need a SWAT team that just does … this. A sales team, with higher commissions and specialized skills, just focused on Stealing Deals / Stealing Deals Back. At a minimum, the best marketing teams do. They track Lost to Competition Leads as ones they get a new shot every 12-24-36 months down the road. A bit more here: How to Steal a Customer From the Competition | SaaStr

(note: a classic SaaStr post updated) The post Want To Steal a Customer from the Competition? You Gotta Do The Work appeared first on SaaStr. |

| Dear SaaStr: Should I Move Our Fiscal Year From Dec 31 to Jan 31? Will It Help The Team? Posted: 22 Jan 2022 06:57 AM PST

There’s a natural evolution as you scale a SaaS company. In the beginning, every day can almost seem life and death. Every single deal feels critical. Sales cycles seem so long, and you can barely even see a quarter ahead, let alone a year. Peter Gassner, CEO of $35B market cap Veeva and I had this discussion at a SaaStr Annual, where in the early days he could only plan about a quarter ahead, max: But then, as you scale, things do get more predictable. Sometimes as early as $4m-$5m ARR, sometimes it can take longer, especially for enterprise deals, where it may not even seem predictable at $15m ARR. But it does get there. And when it does, one of the things that can make sense is to move from montly to quarterly quotas and sales goals. Do this too early, especially in mid-market and SMB and “mixed” (S/M/L) sales, and the sales team often just doesn’t work as hard the first two months of the quarter — and can struggle to make it up the last month. More on that here: But still, in the end, most SaaS companies move to quarterly quotas and projections as they scale. At least past $20m, $30m ARR. Because it all gets more predictable, and a quarterly goal does take a little stress out of the system once there’s enough predictability that you don’t have to worry as much about the first 2 months of a quarter. Another step folks then do is move their fiscal / financial year from Dec 31 to Jan 31. Salesforce does it, and has for a long time, and so do so many other public and later stage SaaS companies. Why? It takes the pressure off the holidays for the sales team — so the team can relax more — and it makes closing deals at year-end a bit easier, as your prospects and customers haven’t gone on break. But there’s a downside. It again removes a little bit of urgency. It removes that pressure to hit the Dec 31 deadline to get those deals in for the year. Jan 31 just isn’t the same. I know some will disagree, and it probably doesn’t matter when your bigger, or have a truly excellent VP of Sales on board. But what I see time and time again, in 2006, 2016, 2022, every single year I’ve been in SaaS … a Dec 31 year-end works. The best SaaS sales team just close more on Dec 31 than you would ever imagine. It’s glorious in fact. More on that here.

But still, you have to go long. It does make the holidays easier on your team if the pressure is off a bit with a Jan 31 fiscal year. The team gets to come back from Christmas break, sell hard, and sell to customers who are 100% for sure working at the end of the month. So my simple recommendation is this: like moving from monthly to quarterly quotas … hold off on moving from Dec 31 to Jan 31 fiscal year. In particular: hold off until you have such a strong VP of Sales in place that you are confident it doesn’t matter. And she is confident also it won’t help. This often isn’t much before $20m-$30m ARR. Until then, hold the line if you can. Stick with a Dec 31 push to close out the year strong. And then after that, after $20m-$30m ARR when you have a great VP of Sales you trust, and you know will hit the plan either way. Well after that, let her decide.

Also, David Sacks of Craft Ventures had a good SaaStr session on how you have to build a cadence here, at least after the early days, after 50+ employees:

The post Dear SaaStr: Should I Move Our Fiscal Year From Dec 31 to Jan 31? Will It Help The Team? appeared first on SaaStr. |

| 7 Changes You Can Make >Today< To Grow Faster Posted: 22 Jan 2022 06:00 AM PST Almost all of our 10,000+ pieces of content and 1,000+ SaaStr sessions and 500+ podcasts are really just about how to do … better. A smidge better. A bit better. Since SaaS compounds, even doing just 5% better now can compound dramatically over time. Everything doesn’t have to be 10x better to move the needle, if it compounds. But a lot of advice takes time to pan out. What are 5+ changes you can make today, or at least this week, to do better? A few thoughts: 1. Visit all prospects and customers in person that have an ACV of >= $50k. The more of your prospects you visit in person, the more that will close. And the more existing customers you visit in person, the better the upsell and revenue retention. Want to increase your close rates, with the leads you already have? Get on a jet. Want to increase your revenue retention? In person. Visit all your customers > $50k every quarter. Just give them a roadmap update and check in. Even with no new leads, and no new customers, this alone will boost your revenue. And you can start Monday. 2. Have a weekly 1-on-1 with a VP/direct report that you don’t have one with right now. Weekly 1-on-1 meetings are critical. They are one of the simplest ways to get more out of the team you already have. Meet each week, in an unstructured way. This will help you surface simple ways you can help then do better. Most of us tend either not to do 1-on-1s, or only do them with some reports. Force yourself to do them with all your reports. And if there’s someone you don’t want to do a 1-on-1 with … that’s a sign she/he should report to someone else. So make that change this week, too. So they report to someone who can be a more effective boss than you. 3. Hire a new recruiter and meet with 30+ new candidates for your #1 open role. As you begin to scale, the gaps on your team can become overwhelming. Because there will be so many of them. Take a breath, and if you want to do better this week, focus on just one key hire. The #1 you need. And find a new recruiter. You need a fresh perspective. Tell her you want to meet 30 candidates in 60 days, if possible, and you are committed to making the hire ASAP. That will motivate both of you. And pay up. A recruiter fee is tiny compared to the value a top VP will bring. 4. Set a burn-rate budget for each and every month. This will focus your team and de-stress your life. Most of us come up with a rough budget for the year, but not a burn-rate budget for each month. This will force everyone on the team, starting Monday, to collaborate on hiring and other trade-offs. If you go over the budget, now everyone will know. In close to real-time. This will almost immediately improve the efficiency of your limited budgets, and improve teamwork. And you will make better decisions on where to deploy your limited resources. Which will not just manage your burn rate — but increase your revenues. Starting Monday. 5. Cut out toxic folks. Most of us keep / sit on a hire or two that has strong skills, that we feel we need, but that is dragging down the team. It turns out, you don’t need them. It turns out, the week you move them out of the company, the folks that are great and positive will somehow fill the gap, someway. And it turns out, you’ll do better just one week after moving the super experienced, but toxic folks out. Do it this week. Do it on Monday. And you will do better this month. 6. Specialize and Segment Your Sales and Customer Success Teams. If you aren't doing this yet, it's time. Split your sales teams into at least 2-3 teams focused on small, medium and large or smaller vs larger customers. Almost everyone has a "commercial" sales and commercial success team focused on smaller customers. Specialize here and your close rates and NRR will go up. You can roll this out this month. You probably already know who to put on which team. 7. Add a real Customer Marketing function, and spend at least 20% of your marketing dollars and time on existing customers. Almost all of us wait way too long to add Customer Marketing. But if 90% of the revenue from customers is after the first dollar in, and especially if you see NRR of 100% or more, then marketing should only start when the customer first e-signs. You'll job is to increase the odds they stay happy, and buy more from you. More content, more webinars, more drip marketing, more help, more events, more steak dinners more your existing customers. Not just the potential ones. Ultimately you need to have a full-time here. But you can probably start with whatever resources you have now. Scaling a SaaS company past say 100 customers, $1m ARR, or even earlier, is as much about making fewer mistakes than it is about going faster, bigger, strong. Take as many actions as you can to just do a bit better. And above are 5 you can take this week. Make it so. (Note: an updated SaaStr Classic post) The post 7 Changes You Can Make >Today< To Grow Faster appeared first on SaaStr. |

| You are subscribed to email updates from SaaStr. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

BeKind

BeKind

agreed

agreed

No comments:

Post a Comment