Visual Capitalist |

- The Data Behind America’s H-1B Visa Program

- The State of Household Debt in America

- White Hot North: Residential Real Estate Investment in Canada

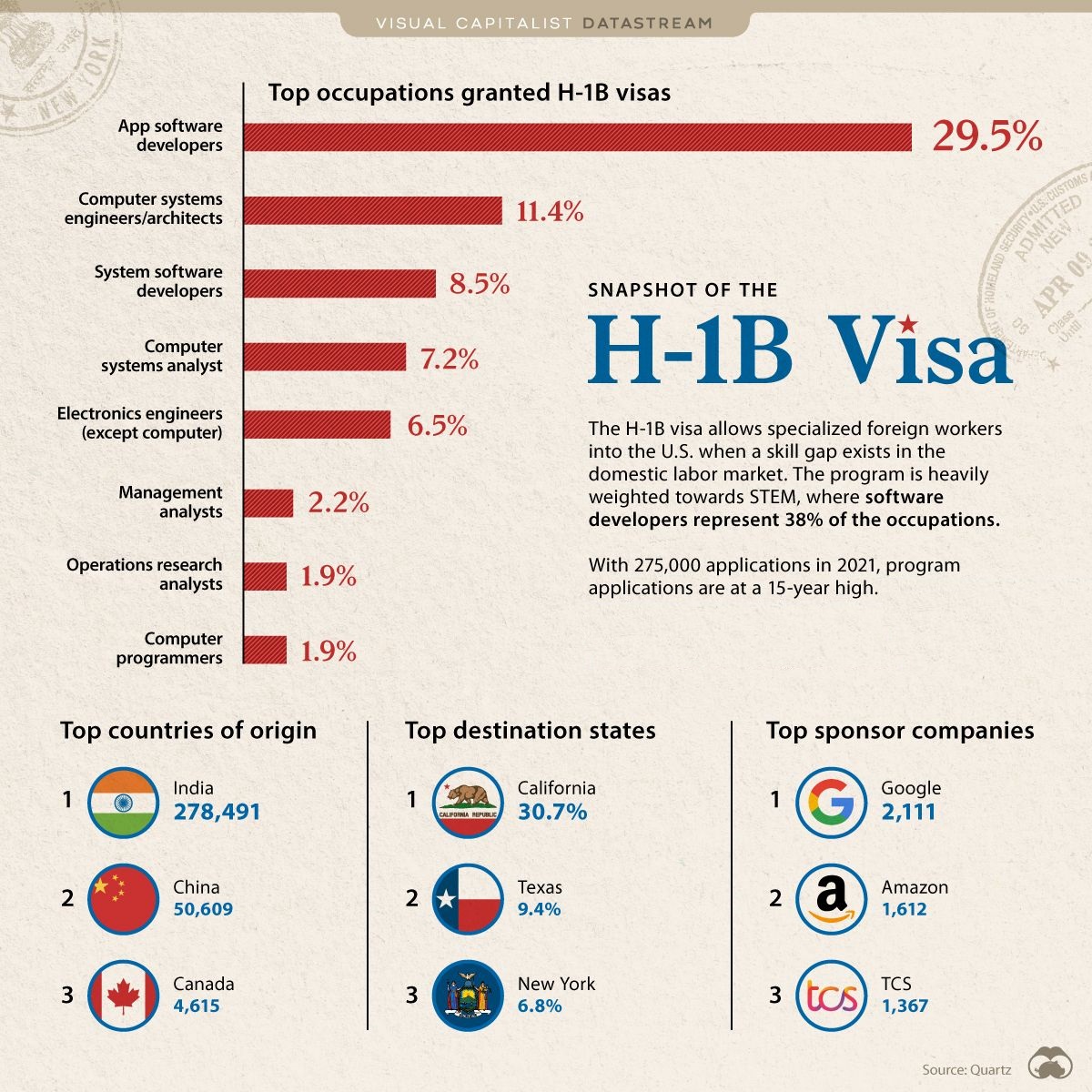

| The Data Behind America’s H-1B Visa Program Posted: 17 May 2021 07:53 PM PDT

The Briefing

H-1B Visa OriginsThe H-1B Visa is an immigration program that brings highly skilled workers into America when a shortage of those skills exists in the domestic labor market. The program came to life as part of the Immigration Act of 1990, under the George H.W. Bush administration. Although the program was temporarily suspended for 10 months under the Trump administration, this stoppage has since been lifted by Biden. Though regulations permit specialized knowledge workers from various fields, it is primarily tech jobs that crowd these occupations. For instance, software developers and computer systems engineers/architects collectively cover almost 50% of all roles. Competition IntensifiesThe H-1B visa is highly competitive. In fiscal 2021, program applications hit 275,000, a 15-year high. The program follows a lottery system where 85,000 applicants are selected at random. Today, that means a given applicant has about a 30% chance of getting in.

Although the system is a lottery, the first 20,000 spots are reserved for those with a master's degree or higher, so those holding a higher education tend to have improved odds. Roughly two-thirds of applicants come from India. The large Indian presence exists in the sponsor companies list as well. Tata Consultancy Services (TCS) is an IT services and consulting company, headquartered in Mumbai, India. In addition to being a top visa sponsor, they’re also among the top two US recruiters of IT services talent, an industry India thrives in. The company trades on the National Stock Exchange of India (NSE) and hold a market cap of $160 billion (₹12 trillion). America’s Immigration QuestionUnlike some other immigration programs, the H-1B visa is not permanent, with a duration of stay between three to six years, contingent on maintaining employment. Should a termination occur, the person must leave the U.S. within the 60-day grace period. America’s view on immigration can fluctuate over time, affecting application numbers in some cases, like for university and MBA programs. A 2020 poll showed that "the social and political climate in the U.S." and "feeling welcome in the U.S." were two growing factors for a decline in international students over the last few years. But as of now, it looks like this sentiment hasn’t transferred over to H-1B Visa applicants and the program remains more attractive than ever. Where does this data come from? Source: Quartz The post The Data Behind America’s H-1B Visa Program appeared first on Visual Capitalist. | ||||||||||||||||||||||||||||||||

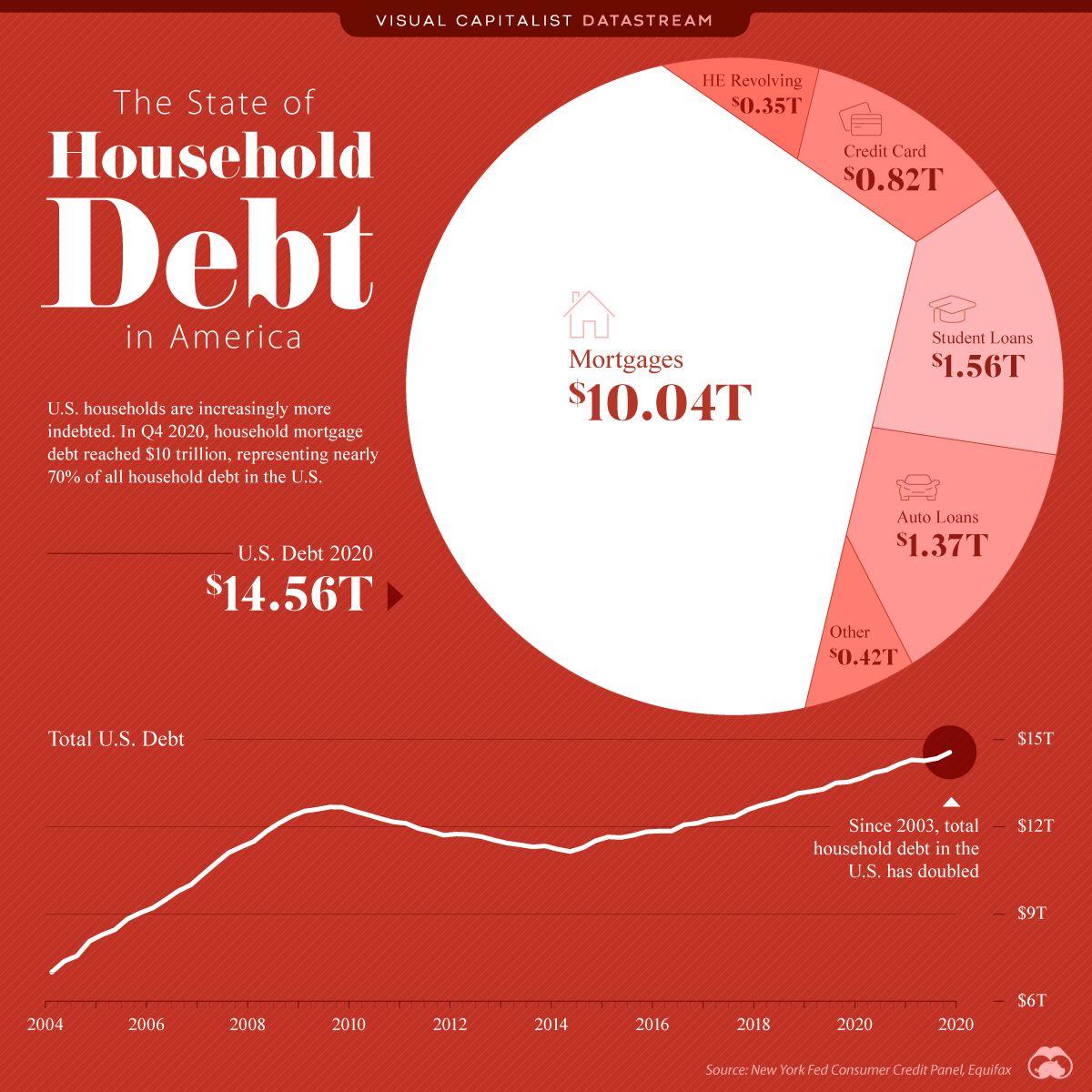

| The State of Household Debt in America Posted: 16 May 2021 10:41 PM PDT

The Briefing

The State of Household Debt in AmericaAmerican households are becoming increasingly indebted. In 2003, total household debt was $7.23 trillion, but that figure has recently doubled to $14.56 trillion in 2020. With just under 130 million households in the country, this equates to an average of $118,000 of debt per household. Here’s how the various forms of U.S. household debt compare.

Mortgages: Steep Price to Pay for Home OwnershipMaking up roughly 70% of all household debt, and growing $5.1 trillion since 2003, mortgage debt now stands at $10.04 trillion. A fundamental driver of mortgage activity is interest rates. Given the two variables tend to have an inverse relationship with one another, interest rates have a big impact on the affordability of housing. As long as U.S. interest rates remain near 200-year lows, its likely mortgages will maintain at elevated levels. Students Continue Struggling with Student DebtThe second-largest form of debt is student loans. Although not quite the size of mortgages in raw dollars, student debt is the fastest growing as a percentage, having shot up 550% from 2003 to 2020. The topic of debt is highly discussed in today’s political and economic climate. That’s largely because debt has risen on all fronts to unprecedented levels. For example, the U.S. national debt has recently passed $27 trillion while corporate debt stands at $10.5 trillion. Throw the aforementioned household debt into the mix and you have a $52 trillion debt pile. That’s a big bill to pay. Where does this data come from? Source: Federal Reserve Bank of New York The post The State of Household Debt in America appeared first on Visual Capitalist. | ||||||||||||||||||||||||||||||||

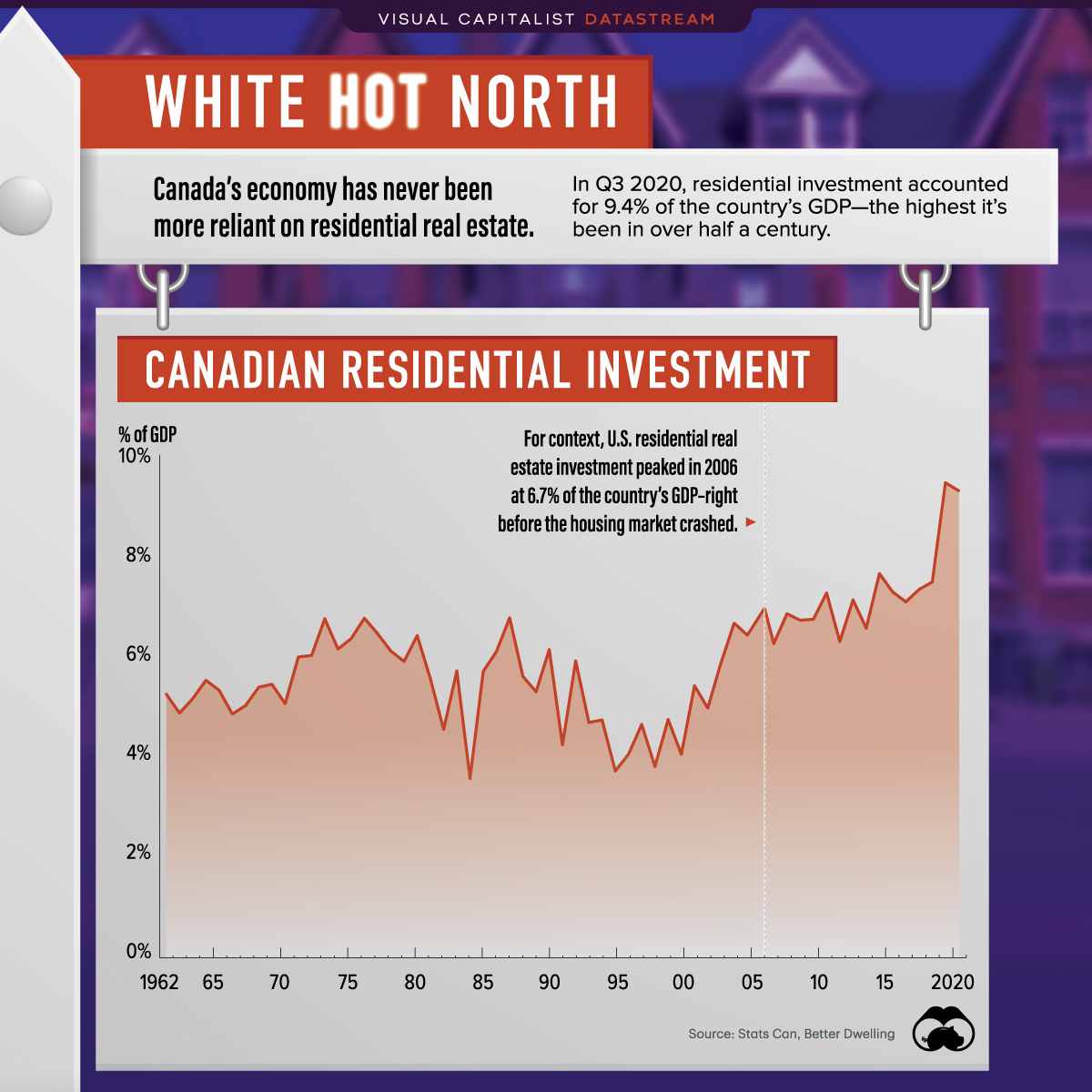

| White Hot North: Residential Real Estate Investment in Canada Posted: 16 May 2021 10:21 PM PDT

The Briefing

White Hot North: Residential Real Estate Investment in CanadaResidential real estate is breaking records in Canada. As of Q4’2020, it accounted for 9.3% of the country’s GDP. The purchase, sale, and construction of new homes in Canada currently makes up more of the country's economy than it does in any other developed country. There's No Place Like HomeSo why is there so much investment going into building residential structures? Here’s a look at just a few reasons:

The steady flow of immigration into Canada is a significant factor behind increased residential real estate investment. Prior to the pandemic, the country welcomed around 300,000 newcomers per year—increasing the demand for housing, particularly in urban hubs like Toronto and Vancouver. Mortgage rates have also been steadily falling, making it easier to purchase a home. As of the latest 2020 data Canadian 5-year uninsured mortgage rates sat at 2.1%, compared to a steep peak in the beginning of 2019 at 3.7%. Additionally, some individuals may have become more capable of affording a new home as increased saving rates have become a widespread trend during the pandemic, potentially adding to demand. This combined with increasingly flexible remote work options are increasing real estate activity around the country. Higher Stress TestsThe increased demand has caused prices to skyrocket. As it stands now, if the housing bubble doesn't burst, prices will continue to rise, and could become a major wedge separating those who can afford the increasing prices and those who cannot. Two major Canadian cities—Vancouver and Toronto—are already among the least affordable cities in the world due to low vacancy rates and the immense demand. According to CBC, the country's top banking regulator is making a proposal to raise the mortgage stress test level. The idea is to raise it to 5.25% or 2 percentage points above the market rate, whichever is higher. This would be up from the current rate of 4.79% posted rate at Canada’s biggest lenders. Borrowers will have to prove their ability to take out a loan at the higher rate, regardless of the lender's ability to provide the loan at a lower one, in order to relieve some of the pressure on housing prices. Where does this data come from? Source: Stats Can, Better Dwelling The post White Hot North: Residential Real Estate Investment in Canada appeared first on Visual Capitalist. |

| You are subscribed to email updates from Visual Capitalist. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment