| This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here. In This Issue: Articles, Research & Spotlights - Texas Enacts Landmark Pension Reform

- These States Are Leading the Way on Pension Reform

- Annuities Can Help Improve Michigan’s Defined Contribution Retirement Plans

- Succesful Public Retirement Reforms Help Workers and Taxpayers

News in Brief

Quotable Quotes on Pension Reform

Contact the Pension Reform Help Desk

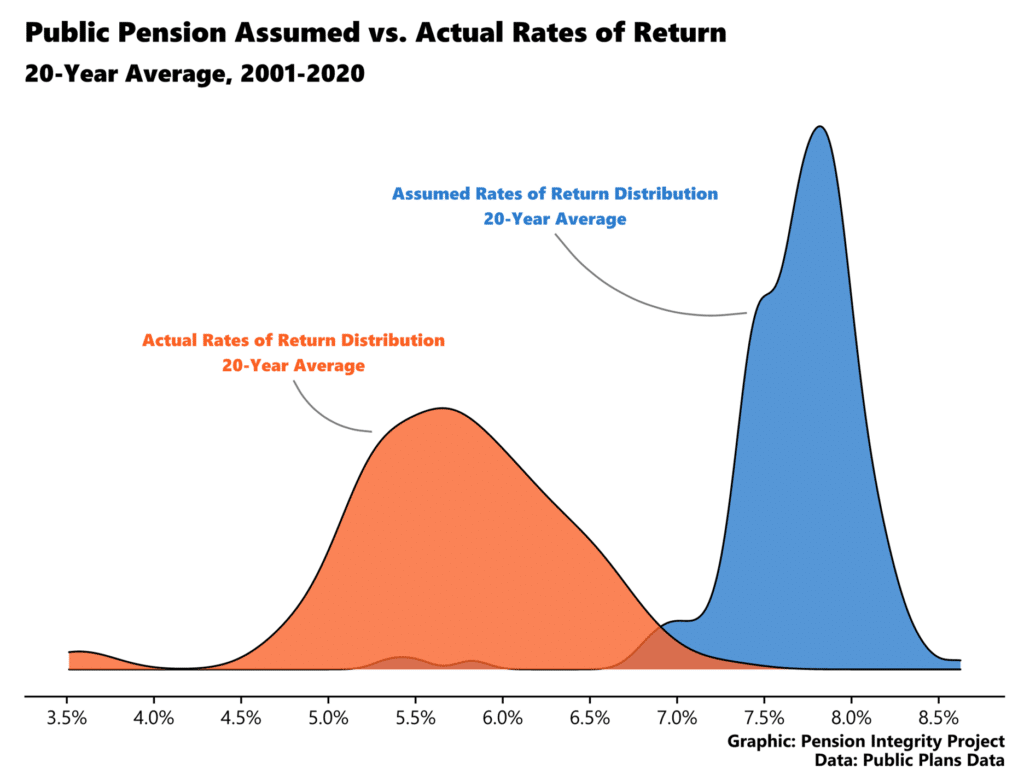

Articles, Research & Spotlights Landmark Texas Pension Reform Law Tackles Funding Issues, Secures Employees’ Retirement Benefits On June 18, Texas Gov. Greg Abbott signed major reform of the Employees Retirement System (ERS) into law. The new law will improve pension funding and reduce the accrual of pension debt in Texas by establishing a cash balance retirement plan for future state employees and committing the state to pay the annual contributions necessary to fully fund the plan within 30 years. These reforms will benefit both employees and taxpayers. This analysis details the reforms, the bipartisan and collaborative effort involved in passing Senate Bill 321, and the Pension Integrity Project’s role in the process leading up to the law’s passage. While there is still room for lawmakers to make additional improvements via future reforms, other states should look to Texas as an example of how to implement meaningful pension reform. Reason in The Wall Street Journal: These States Are Leading the Way on Pension Reform Pension debt is growing nationwide and most states are grappling with the challenge of reforming their retirement plans to avoid future costs and effectively pay down the significant debt that has accrued over the last two decades. In an opinion piece appearing in The Wall Street Journal, Reason’s Leonard Gilroy and Steven Gassenberger highlight how Texas, Arizona, New Mexico, Colorado, and Michigan have succeeded in enacting the right types of pension reform that protect public workers and taxpayers from continued runaway costs. Annuity Offerings Can Help Improve Michigan’s Defined Contribution Retirement Plans Legislation currently under consideration in Michigan would offer valuable investment and annuity options to state workers. The policy proposal would bring the state’s defined contribution retirement plans more in line with industry best practices. Reason Foundation senior fellows Richard Hiller and Rod Crane explain how these reforms would improve Michigan’s ability to provide lifetime retirement income to state workers, which would benefit both plan members and employers. These two bills would be a continuation of years of successful and collaborative retirement reform efforts in the state. Succesful Public Retirement Reforms Are Collaborative, Helping Workers and Taxpayers When working to enact meaningful and lasting reform of public pensions, it is essential to remember the core purpose of a retirement plan: providing a secure retirement benefit to its members. A new commentary from Richard Hiller highlights several examples of cooperative retirement reform efforts showing how policymakers can enact changes that address the crippling public pension debt many governments and taxpayers are facing while also creating an effective retirement plan for today’s modern workforce. Employee-centric reforms should include retirement options that match the realities of the more mobile modern workforce and be enacted through a collaborative process with representation from all involved parties. News in Brief New Reporting Evaluates the Value of State Retirement Benefits The newly released Retirement Security Report from Equable Institute examines the retirement benefits offered to the employees in every state. The interactive report gives important details of every state's public retirement offering, including plan funding, resiliency, and contribution scores. It also gives crucial insight into how members in different age and tenure groups will benefit from each plan. The report finds that 75 percent of retirement plans work advantageously for those who work a full career within state employment. But, only a few state plans, three percent, serve the employees who work there for less than 10 years. This and many more findings from the report are available here. Update to State and Local Pension Funding Report The Center for Retirement Research at Boston College published a 2021 update to their pension funding report, which analyzes historic funding and contribution data through 2020 and estimates 2021 values with what data is already available. They find that despite the recession and uncertainty from the pandemic, overall pension funding levels rose from 72.8 percent in 2020 to 74.7 percent in 2021. Contributions continue to rise, driven by growing amortization payments. They also examine the effect of 2020's sharp decline in employment, explaining the challenges that will arise from reduced payrolls. The brief is available here. Quotable Quotes on Pension Reform "For more than six years, I have talked about our long-term liabilities in ERS, and I am thankful the Legislature took much-needed action this year" —Texas Comptroller Glenn Hegar, in a press release, "Texas Comptroller Glenn Hegar Certifies 2022-23 State Budget,” June 8, 2021 Data Highlight Each month we feature a pension-related chart or infographic of interest generated by one of our Pension Integrity Project analysts. This month, policy analysts Truong Bui and Jordan Campbell visually compare the assumed rates of return for state and local pension plans to actual investment return results from the last two decades. They display the distribution of investment return assumptions and how they have changed since 2001. Read more about the tool here. Contact the Pension Reform Help Desk Reason Foundation's Pension Reform Help Desk provides information on Reason's work on pension reform and resources for those wishing to pursue pension reform in their states, counties and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org. Follow the discussion on pensions and other governmental reforms at Reason Foundation's website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments and suggestions to zachary.christensen@reason.org.

The post Pension Reform Newsletter: Landmark Reform in Texas, How Annuities Can Improve Retirement Offerings, and More appeared first on Reason Foundation. |

No comments:

Post a Comment