SaaStr |

| 5 Interesting Learnings From Five9 at $550,000,000 in ARR Posted: 04 May 2021 07:55 AM PDT

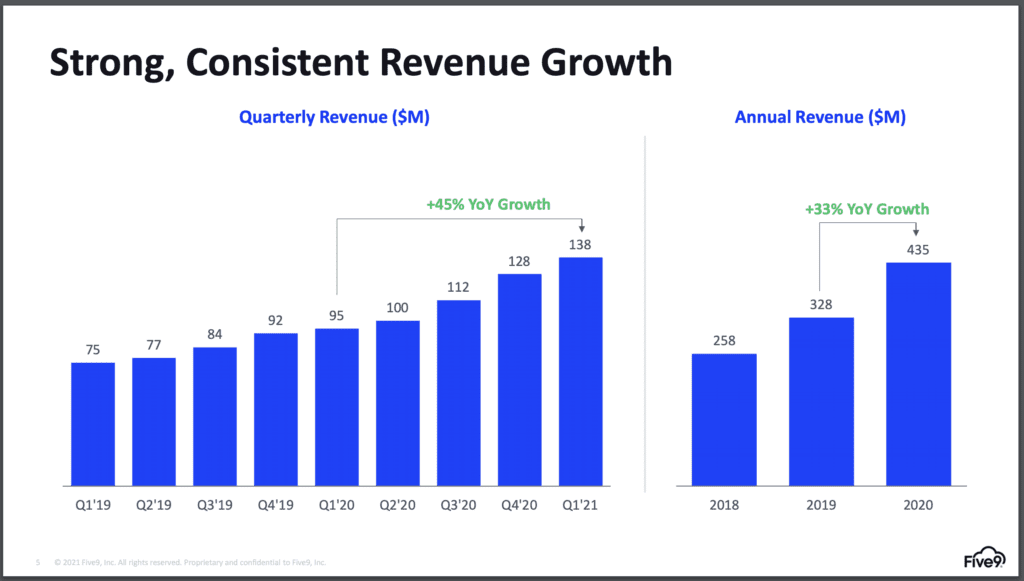

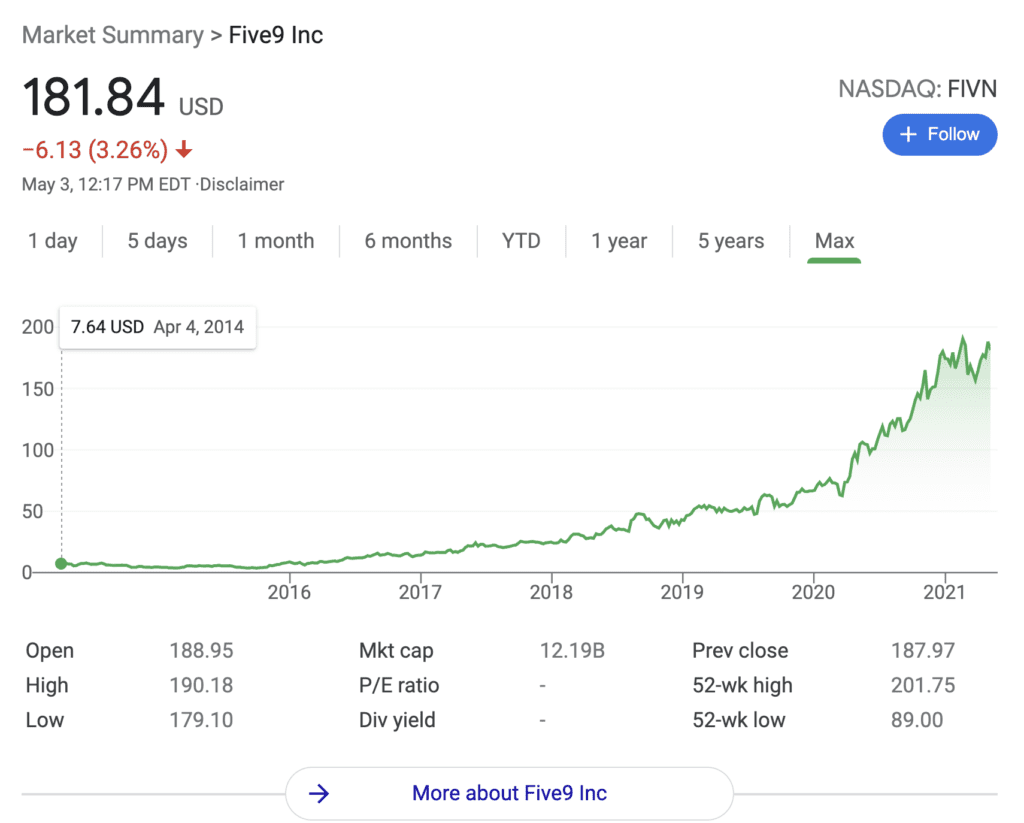

Five9 is a $12B SaaS company many of you haven’t heard of, but it’s an interesting beneficiary of Covid in many ways. While we all saw Zoom and Shopify explode during Covid, Cloud call centers boomed just as much. Overnight, 1000s of call center agents needed to work from home. And in many cases, pre-Covid, they’d been working on decades-old server-based phone systems. Pre-Cloud systems, really. So Five9, Talkdesk, RingCentral, Dialpad and more boomed during Covid. Five9 is particularly interesting. It’s old, founded in 2001. It wasn’t a rocketship. In 2014, when I invested in then up-and-comer Talkdesk, it had long since IPO’d and was struggling at a $200m market cap. But fast forward today, and it’s worth 60x more. $12 Billion! And it’s growing a stunning 45% (!) at $550m ARR.

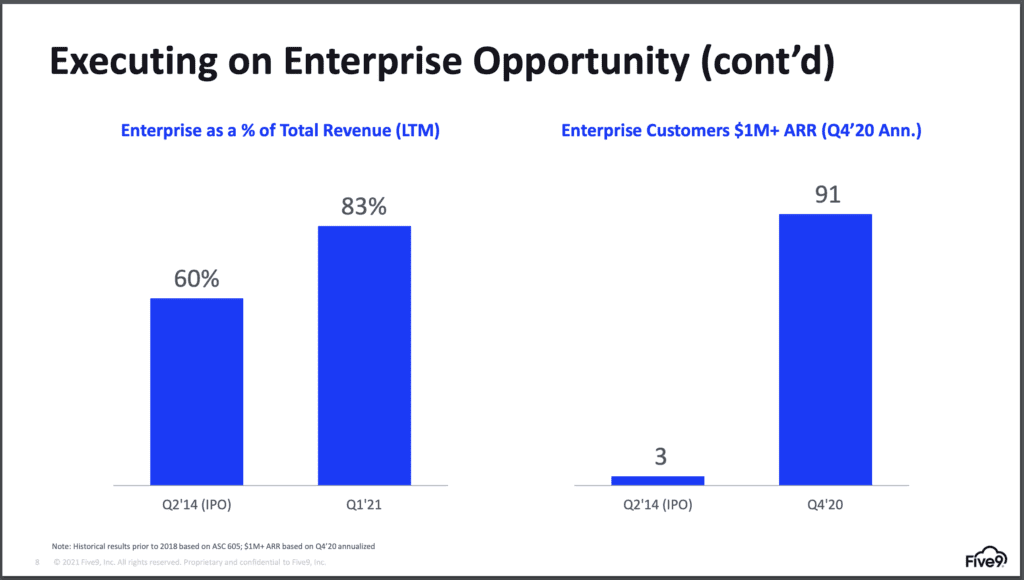

Never quit. Stay in the game. Sometimes, you really are a bit too early like Five9. Sometimes, when you are, you’ll have to rebuild all your technology, and that’s painful. But Five9 shows it can be done. You can be that decacorn. OK so now 5 Interesting Learnings at $550,000,000 in ARR: #1. Going more enterprise has fueled growth. Five9’s revenues were 60% enterprise at IPO in 2014, but now are 83% enterprise. And Five9 has grown from just 3 $1m ACV customers in 2014 to 91 today:

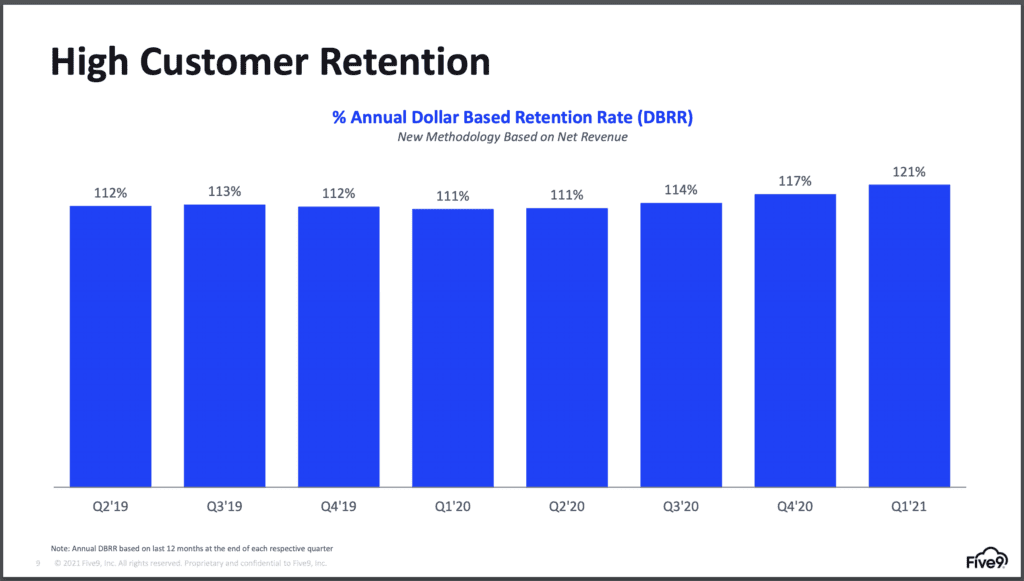

#2. NRR has grown from OK to Great in past 24 months. Five9’s NRR was a so-so 112% until recently — not that impressive for a mission-critical enterprise app. But they’ve since grown it to a more top-tier 121%. A reminder it’s never too late to increase your NPS and NRR. Make it so!

#3. Growing both new logos and upsells at all-time records. This is a good sign. Too many SaaS leaders rely on the installed bath for growth. But Five9 found a way to reignite new logo growth. New logos also hit an all-time record in Q1’21.

#4. Partners influence 2/3ds of all deals. It takes a village in the enterprise, folks. Your app needs a lot of other apps and partners and SIs to really deliver value in the enterprise. 66% of Five9’s revenue is influenced by partners. Most of us don’t do enough here. How about you? Especially in highly competitive spaces, partners really can move the needle when prospects decide which vendor to pick.

#5. Gross margins of 57% (65% on an “adjusted” basis). Five9 has increased its growth margins over time, but telephony and communications have real costs. Like Twilio, Five9 will likely never have the 70%-80%+ gross margins of a software-only company. But also like Twilio, the public markets seem OK with that and aren’t penalizing Cloud communication leaders with lower multiples due to their lower gross margins.

Wow, what a story. Five9 never gave up. The IPO was tough to pull off. The road to going more enterprise was long. And the space is brutally competitive. And today, 20 years after founding, it’s a $12B category leader. Not too bad!

The post 5 Interesting Learnings From Five9 at $550,000,000 in ARR appeared first on SaaStr. |

| 10 Things That Tell a VC You May Not Be Ready for “Prime Time” Posted: 04 May 2021 06:20 AM PDT Being an amateur is OK, even endearing — if it’s authentic. And up to a point. But here are some things that founders do that perhaps suggest you aren't yet ready to raise venture capital. The good news is, it’s really easy to course-correct and just not do these things:

(note: an updated SaaStr Classic post) The post 10 Things That Tell a VC You May Not Be Ready for “Prime Time” appeared first on SaaStr. |

| You are subscribed to email updates from SaaStr. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Just not overnight. In fact, the first 15 years or so were a bit slow. But then … boom!!

Just not overnight. In fact, the first 15 years or so were a bit slow. But then … boom!!

No comments:

Post a Comment