SaaStr |

- SaaStr Podcast #429 with ProfitWell Founder & CEO Patrick Campbell: “The Current State of SaaS Companies, Subscriptions, and Retention in 2021”

- VCs Run Out of Money (Sort of). Here’s How & What That Means.

- 4 Tips To Earn Respect as a Young SaaS CEO

| Posted: 13 May 2021 03:07 PM PDT

Ep. #429: In this episode, ProfitWell Founder & CEO Patrick Campbell shares benchmarks from over 23,000 companies and offers a helpful framework to re-evaluate your retention strategy and increase your CLV (Customer Lifetime Value) between 10 and 60%. This episode is an excerpt of Patrick’s session from SaaStr University: Spring Semester conference. Watch the full video here.

If you would like to find out more about the show and the guests presented, you can follow us on Twitter here: Jason Lemkin The post SaaStr Podcast #429 with ProfitWell Founder & CEO Patrick Campbell: “The Current State of SaaS Companies, Subscriptions, and Retention in 2021” appeared first on SaaStr. |

| VCs Run Out of Money (Sort of). Here’s How & What That Means. Posted: 13 May 2021 07:45 AM PDT As the number of Cloud and SaaS IPOs increase, each one becomes a little case study. We’ve looked at many of them in our 5 Interesting Learnings series. And one thing we can see is that many big successes were far from overnight success stories:

These long-time-to-success stories are more common that you might think, and worth of their own post. But here, we’re going to use them just to illustrate a point. Your VCs can run out of money — for later checks. Just understand that if you ask for money years later. And especially if it just takes longer to get to that next round that you were planning. How does this work? Well, VC funds typically last 10-15 years, but do all or most of their brand new investments the first 2-4 years. They might deploy 40% of the total fund into these first checks. The rest is then used for later, follow-on rounds into these existing investments. But eventually, the fund starts to run low on “reserve” cash for later rounds and bridges. That 60% of the fund earmarked for later rounds gets used up bit-by-bit, check by check. Now for the mega winners, VCs can always find more money. They can use other vehicles like Opportunity Funds and SPVs for their very top winners. But that’s opportunistic and doesn’t really help you as a founder. That money comes from other places, just for the very top performers. Just be aware of this: 7-8 years into the life of a specific VC fund, it starts to run out of money. After that, there’s often very little left. How do you know? Just ask. It’s OK. Ask how much of the fund is left. Ask if your VCs have more cash for the next round. Ask more specifically “what percent are you deployed in the fund?”. Folks will generally tell you. If the answer is much more than 80%, money will get tight. Around Year 9-10 of a fund, it’s often close to 100%. And then the specific VC fund you are in really will be close to out of money. The post VCs Run Out of Money (Sort of). Here’s How & What That Means. appeared first on SaaStr. |

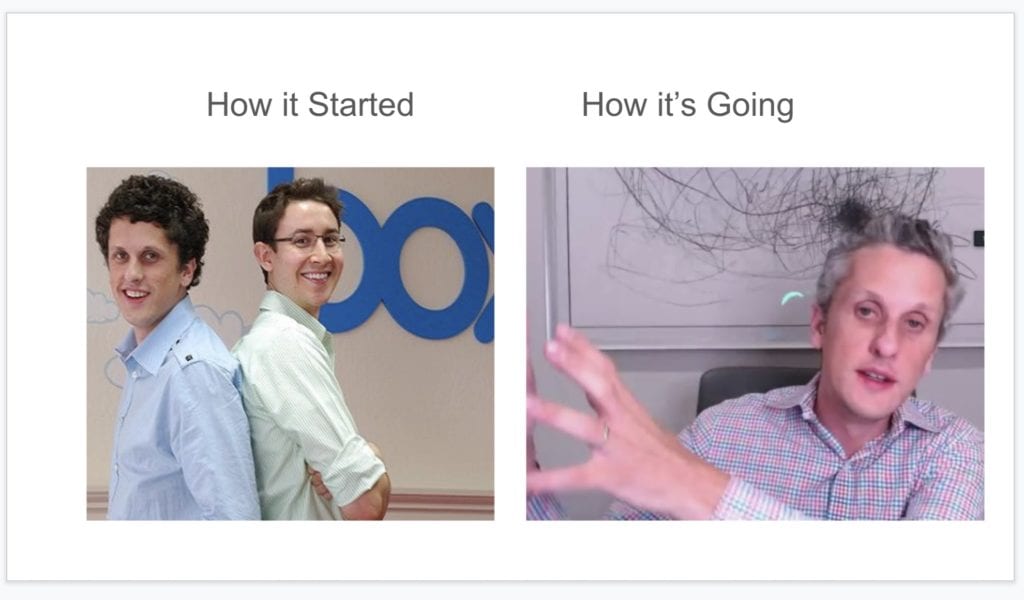

| 4 Tips To Earn Respect as a Young SaaS CEO Posted: 13 May 2021 06:20 AM PDT While age ultimately doesn’t matter — results do — in SaaS, starting off as younger-than-average can create some challenges in a sales- and customer-driven environment. Aaron Levie started Box at 19, Mark Zuckerberg and Bill Gates dropped out at 19-ish, Melanie Perkins started Canva at 25, Anthony Casalana started Squarespace at 21. Tobi Lutke started Shopify at 26.  So just some hacks to potentially make it easier:

(note: an updated SaaStr Classic post) The post 4 Tips To Earn Respect as a Young SaaS CEO appeared first on SaaStr. |

| You are subscribed to email updates from SaaStr. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment